Refinance Car Loan Rates

They offer an interest rate estimator tool with no credit check based on your overall credit profile.

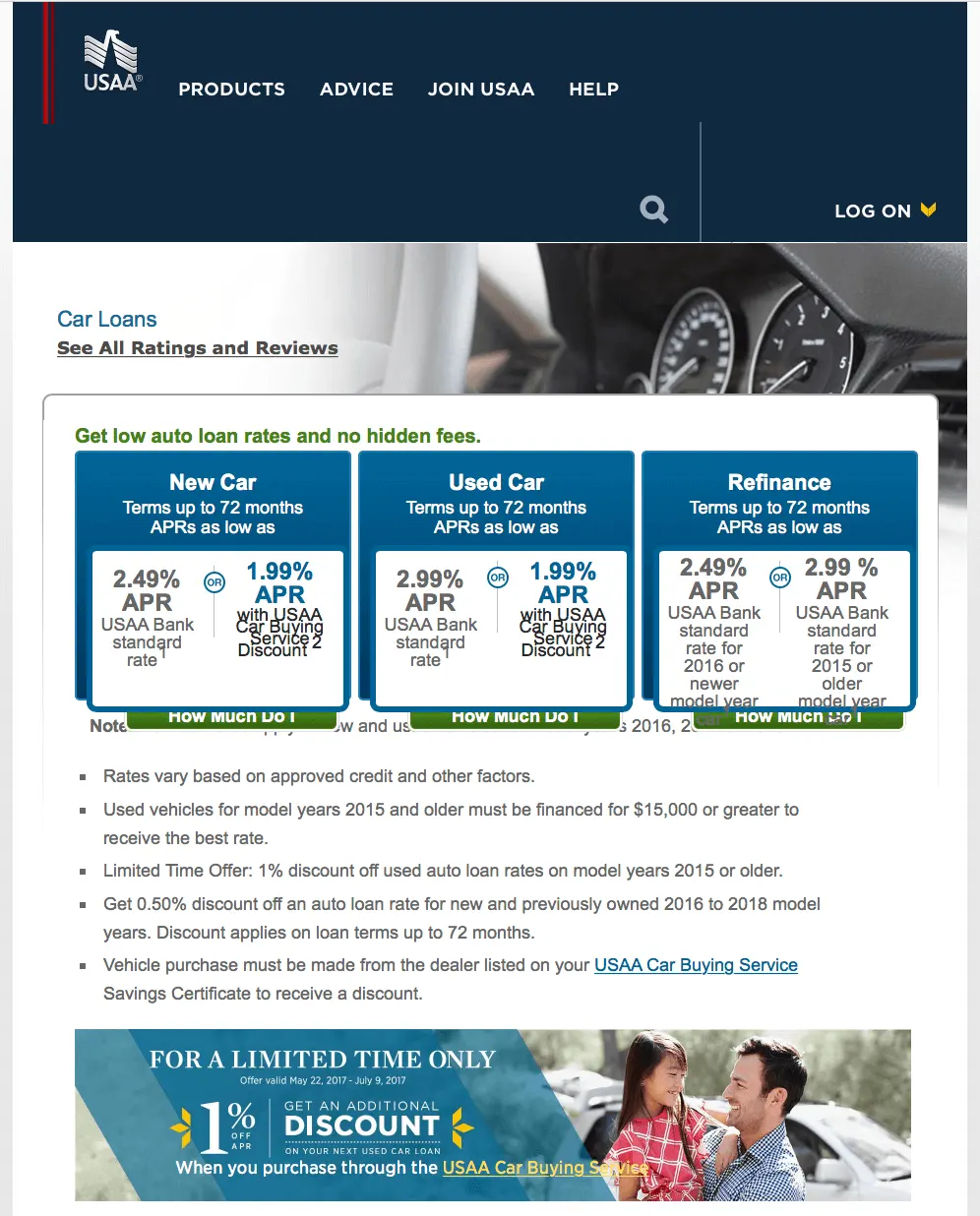

Refinance car loan rates. The average credit score of an autopay customer is 706 which receives on average a 549 interest loan. Do keep in mind that you will not be able to refinance your existing loan within the same bank. Compare car refinance rates and savings with this free interactive tool. Compare your current loan with offers from other sources your bank or credit union an online lender etc to see if you can get a lower interest rate with a refinance car loan.

Suntrust car loan refinancing offers competitive interest rates and flexible terms. They seem to specialized in refi as their listed refinance rates are lower than their newused car purchase loan rates. Compare auto loan rates. Most often the new loan amount will be the balance left on your current car loan.

Refinance for as low as 204 apr for 36 months. When you refinance your auto loan you are replacing your current car loan with a new loan preferably at a lower interest rate and better terms. Refinancing your auto loan could lower your monthly payment and save you hundreds. An auto refinance is the process of applying for a new auto loan to pay off your existing auto loan hopefully with a better interest rate and better terms.

Knowing your credit score ahead of time makes a big difference in estimating what your apr will be on refinancing a car loan. See rates for new and used car loans and find auto loan refinance rates from lenders. Car loan refinancing is a good idea if you get a better interest rate or if you get better loan terms due to an improvement in your credit scorefinancial condition during your current loan tenure. If your credit score has improved or if interest rates have gone down since you first financed your car refinancing your auto loan could lower your monthly payment and save you thousands of dollars over the life of your loan.

No payments for up to 90 days for qualified borrowers.