Best Credit Score To Buy A Car

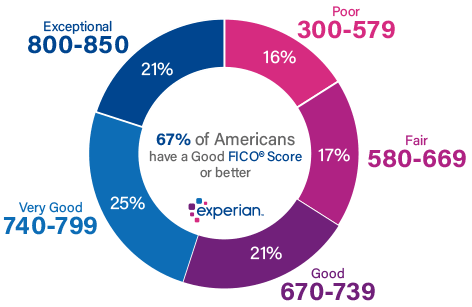

Borrowers who received financing for a new car in q4 2018 had an average credit score of 718.

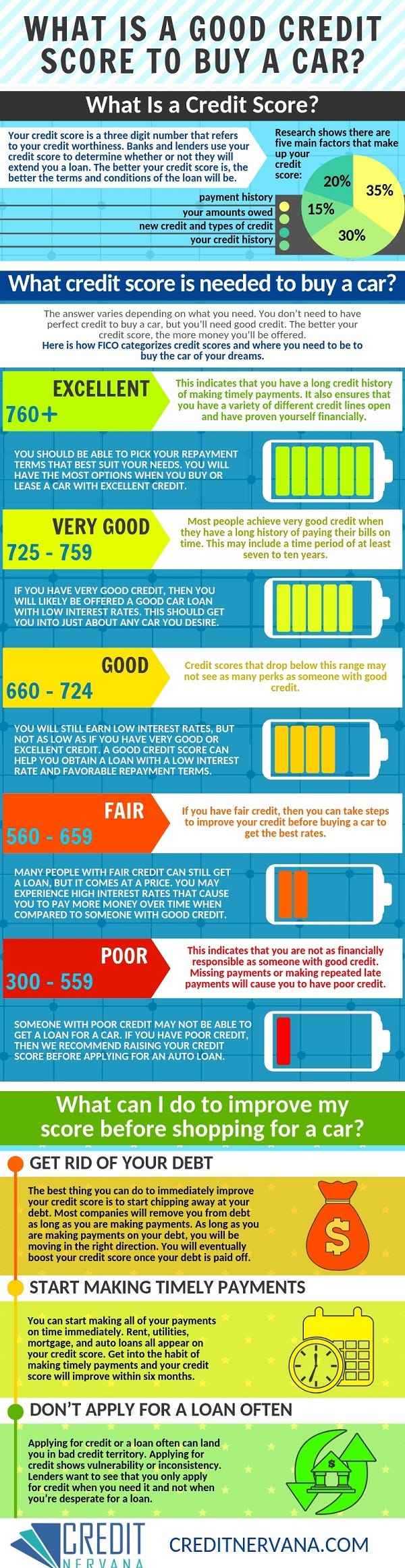

Best credit score to buy a car. A credit score thats good enough to get you an auto loan may not be high enough to get you a decent deal on a lease. A good credit score to buy a car is usually above 660 which is the minimum score to be considered a prime borrower by experian. Lower credit scores can drive up the interest rate offered to you. The average car loan interest rate for people with a fair credit score of 650 699 is 1169 for a new car and 1194 for a used car.

Car loan rates vary greatly depending on what score you have so before you start eyeing up 30000 cars assuming you can afford the payments know what credit range your fico scores are in. In general leasing a car requires you to have an excellent credit score. However theres no industry wide official minimum credit score. In late 2019 the average score for a new car loan was 715 and 662 for a used car loan.

Dont just order one of them and assume it is going to be the same as the other two. To offset risks the lender will often extend a higher interest rate. Inform yourself about the possibilities of improving your credit score. But borrowers with scores as low as 600 or even 500 have options.

If you need to wait 6 or 12 months to see your credit score improve and then start looking for an auto loan. Even a small bump in your credit score rating can get you a long way in terms of getting a better deal when buying a car. Credit scores and car leasing. Poor credit 450 649 subprime borrowers or people with poor credit scores of 450 649 average an interest rate of 1708 for a new car and 1733 for a used car.

Someone with lower credit scores is considered a higher risk borrower.