Hybrid Car Tax Credit

Alternative motor vehicle tax credit.

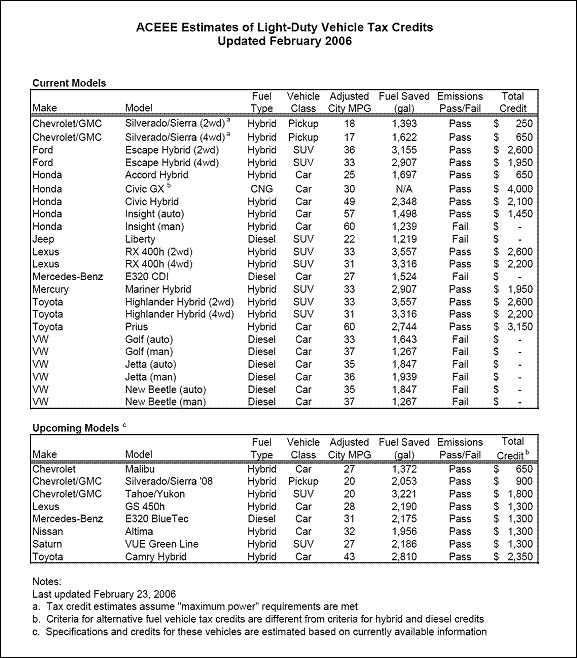

Hybrid car tax credit. The maximum credit for most hybrids was 3400. Electric vehicle tax credit. Department of energy you can receive a tax credit of. Here the leasing company which is legally the cars owner claims the federal tax credit and uses it to lower a lessees monthly payments.

A federal hybrid car tax credit is available to consumers who buy plug in electric vehicles evs in the united states. The tax credits for hybrid cars took effect in january 2006. All electric and plug in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. The idea was to encourage people to buy energy efficient hybrids even though they were more expensive than comparable gas only vehicles.

According to the us. Consumer reports tells you which hybrid and electric cars to consider buying now in case the. Simply answer a couple of. Written by ivan phillips.

Ive been driving an ev for several years now and have thoroughly researched state and federal tax credits and other incentives for a future purchase as well. The government decided to make things easier for owners of. These vehicle tax credits are available for 2019 tax returns. The credits phased out after a manufacturer sold 60000 of a hybrid model.

The state will allow an income tax credit of 10 of the total vehicle cost up to 1500 if the incremental cost of a new afv cannot be determined or when an afv is resold as long as an income tax credit has not been previously taken on the vehicle. Federal tax credits for new all electric and plug in hybrid vehicles federal tax credit up to 7500. 2020 hybrid car tax credit. The credit amount will vary based on the capacity of the battery used to power the vehicle.

As we head into 2020 electric ev and plug in phev vehicles are getting more popular. On january 11 2020. Federal electric vehicle incentives those choosing full electric cars are eligible for the top 7500 federal tax credit. Everything you need to know in this article well tell you everything you need to know about the federal tax credit available for 2020.

Qualified plug in electric drive motor vehicle tax credit. The gop tax plan calls for ending the plug in hybrid and electric car tax credit after this year. All credits end with purchases made by the end of 2010.